Diversification Part III: Application of Systematic Quality Factors onto Broadly Diversified Token Portfolios

In Part I of this series, we highlighted the benefits of diversification in liquid token portfolios. Back-tested results indicate that a more broadly diversified portfolio (Top 75, 100) offers better absolute and risk-adjusted returns than a minimally diversified portfolio (Top 10).

In Part III of this series, we demonstrate further value can be captured in an equal-weight Top 100 portfolio via the additional application of systematic “quality” factors.

We liken the simple, unfiltered Top 100 portfolio to a block of marble, and let our systematic filters serve as chisels to unlock significant alpha hiding within.

Intro and Summary of Findings from Part I

In Part I of this series, we challenged the perception that there are few, if any, benefits to diversification in crypto portfolios. The key drivers of this prevailing rationale are twofold: (1) academic research, such as this recent piece by the Chicago Fed, suggesting that cryptocurrencies are highly interconnected, making it difficult to construct a diversified portfolio with improved risk/return metrics vs a single cryptocurrency; and (2) the common perception that the vast majority of tokens, outside say the Top 10 or so, are generally un-investible (or at least littered with junk), and that diversifying into these projects is more of a risk than a benefit.

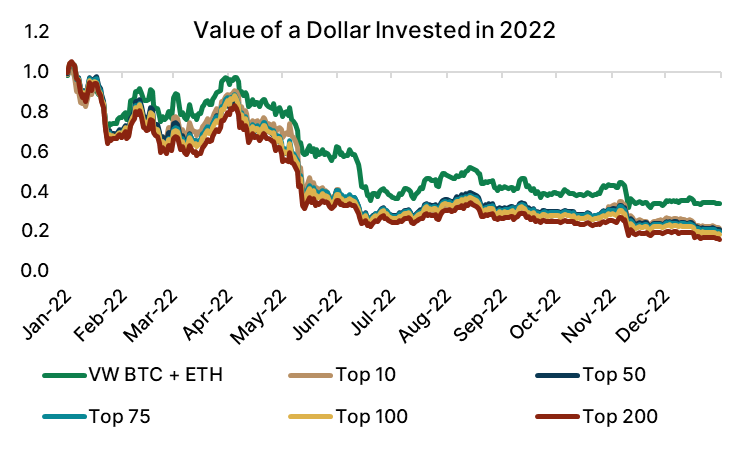

We point to Part I for a qualitative rebuttal of both of these criticisms, but we find it worth reemphasizing the historical performance of broadly diversified portfolios relative to minimally diversified ones. Starting very simply, we show in Exhibit 1 the cumulative returns of different baskets of tokens in each year historically. We see that in 2019 and 2020, a basket of value weighted BTC and ETH outperformed equally weighted baskets of the Top 10 to 200 coins. However, in 2021, the most diversified baskets massively outperformed BTC/ETH, as well as the Top 10 basket.

Exhibit 1: Basket Returns of Dollar Invested at Beginning of Year through Year-End

Normalizing by volatility, we see similar trends (Exhibit 2). Again, 2021 stands out as a turning point, where the broader baskets achieved highly attractive Sharpe ratios. Over time, we see somewhat of a convergence to the BTC/ETH portfolio in terms of returns and volatility: In 2019 and 2020, the Top 10, 100, and 200 posted subpar returns, but also had slightly lower volatility (though not enough to make for a better Sharpe ratio than BTC/ETH). In the next year, 2021, volatility for the broader baskets was somewhat higher, but outperformance was dramatic, and Sharpe ratios were similar across the buckets. And in 2022, returns and volatility have both evened out across the baskets vs BTC/ETH.

Exhibit 2: Risk Adjusted Returns by Basket

Our data shows that diversified portfolios have outperformed minimally diversified ones from 2021 onwards. Some critics may argue that diversification only seems to have produced meaningful outperformance in 2021, which was a unique year for risk assets that is unlikely to be a template for future performance. However, we spent considerable time in Part II of our series discussing how the future could look more like 2021 than earlier years, as the universe of quality projects continues to expand. Furthermore, we seek to demonstrate in the remainder of this piece that further value can be unlocked within a broadly diversified portfolio by careful refinement using systematic quality factors to achieve more compelling risk-adjusted returns. While an unfiltered Top 100 portfolio is maybe “just as good” as holding BTC/ETH, the application of two quality filters discussed herein onto the Top 100 leads to compelling and consistent outperformance relative to key benchmarks.

Learnings from TradFi

Before we delve back into the exciting world of digital assets, we want to take a moment to frame the historical perspective for factor-based investing. Doing so might require a brief detour through the established realm of traditional investing in equity securities. Arguably, factor investing was born of the capital asset pricing model (CAPM), introduced in the 1960s by Jack Treynor1, William F. Sharpe2, John Lintner3, and Jan Mossin4. This model posited that stock returns could be explained by sensitivity to systematic, or market, risk – generally known as beta. The rest of a stock’s return was attributed to company-specific, or idiosyncratic, factors.

While revolutionary, the model was far from complete, and over time investors and academics (including such legendary names as Eugene Fama and Kenneth French5) have observed several additional factors, the most common of which include: Size, Value, Momentum, Quality, and Low-Volatility. Investing along such factors took off over the last couple of decades, and has given rise to an eye-watering number of proposed factors, particularly in the post GFC decade (A study by Harvey and Liu (2019)6 claim over 400 factors have been published in top journals alone).

Whether or not factor investing “works” is a hotly debated issue, but so is nearly every investing approach (these days, nothing from the most passive to the most active strategies is safe from criticism, as the world slowly seems to grasp that investing is not actually a solved problem). Regardless, the strategy has been hugely popular with end-investors, especially as managers rolled the principals of factor-based investing into exchange-traded products that followed specific rules and allowed no further active management. These hybrid active/passive investment strategies (often known as smart beta, or strategic beta) have commanded a huge sum of capital in AUM. Research by Morningstar7 suggests that globally, as of the end of 2021, there were over 1,300 strategic-beta exchange-traded products, with assets totaling ~$1.65 trillion (of which the US alone accounts for ~$1.45 trillion).

Exhibit 3: U.S. Strategic-Beta ETP Asset Growth and Asset Flows

Since being applied to equity markets, investors have turned their attention to applications of factor investing in other asset classes (most prominently fixed income) - to encouraging initial results. However, instead of expanding on the TradFi applications, it is here that we come back to the frontier of investing that is crypto. We believe that applying systematic factor-based strategies in digital assets is a logical, but under-appreciated, opportunity. As we expand on in further sections, we have strong conviction in the potential for carefully-researched and rigorously applied factors and analysis to produce differentiated returns in the crypto space. We view these enhancements as akin to the “smart-beta” or “quantamental” approaches popularized in equities markets in recent years.

Ask an Academic

To be clear, we are not the first to examine factors in cryptocurrency investing. Academic research on the subject goes back to 2017, with early work by Jaron Stoffels8 showing promise of applying Fama & French inspired factors including beta, size, and sentiment (low-minus-high based on market cap divided by daily transaction volume and Google trends data). Liu, Tsyvinski, and Wu9 published research in 2019 analyzing 25 different factors and showing that volatility, size, and momentum capture cross-sectional expected cryptocurrency returns. Shams10 in 2020 added to the body of research by showing that similarities in size, trading volume, age, consensus mechanism, and token industries drive returns in cryptocurrencies, but also that a significant degree of variation can be explained by a “connectivity” measure that compares investors bases based on trading locations. In 2021, Liu and Tsyvinski11 further wrote about how cryptocurrency returns are driven and can be predicted by network factors (user adoption) and momentum. More recently (2022), Cong, Karolyi, Tang, and Zhao12 documented characteristics-based return anomalies in a large cross-section of crypto assets.

This is by no means an exhaustive review of the literature but shows that the topic has been in consideration for several years now. Where we hope our research differs is the focus on a more “investible” (i.e., Top 100) subset of cryptocurrencies as a baseline universe, alongside the general goal of systematically identifying strong projects with underlying value (in keeping with our bullish stance on the utility of blockchain technology and token-based economies).

Our Methodology

The methodology we employ to construct the time series which underpin our analysis is unchanged from that of Part I of this series. To start, we take the Top X tokens, per coinmarketcap.com, at quarterly intervals, filtering for those that have at least $1mm volume in the preceding 24 hours. We also explicitly exclude stablecoins and “wrapped” tokens. At the beginning of each quarter, allocations are equally weighted across tokens, but the weightings within this basket will naturally drift over time as individual token performances vary throughout the quarter. To construct a return series, we simply back out the implied daily returns from the daily value of the aggregated token basket. At the start of each new quarter, we redefine the basket constituents based on the updated market cap data and reset the weightings back to equal weight.

Inspiration for our Analysis

Looking back at our work in Part I of this diversification series, the potential power of systematic quality filters is most apparent when examining the decomposition of the Top 100 by performance decile (Exhibit 4). Not only do the worst performing tokens lose an average of over 50% in the quarter, but they also reduce the overall portfolio weighting on the best performing tokens. Thus, applying factors that are more likely to screen out the worst performing tokens should significantly improve portfolio returns. If one manages to exclude the 10 worst performers (and re-weights the portfolio over 90 tokens), average quarterly returns improve by ~9% – a meaningful benefit to pursue.

Exhibit 4: Returns by Decile Within Top 100

While it is impossible (or at least highly implausible) that there are any indicators or factors that can have a perfect hit rate on excluding the worst performers without excluding any of the winners, the hit rate does not have to be perfect to still realize a meaningful increase in performance. We believe that through the systematic application of rules-based filters, we can identify tokens that are more likely, though not guaranteed, to underperform, and over the long-run this edge will compound into consistent outperformance. The key here is relying on data and empirical evidence as the basis of token selection / screening, rather than token picking from a bottoms-up fundamental perspective, which we see as antithetical to the goal of a broadly diversified portfolio. Additionally, as we discussed in Part I, there is ample academic13 and practical14 evidence citing the coin-toss-like outcomes of discretionary security selection, and the lack of persistence in outperformance of such strategies.

Layering on the Factors

For the purposes of this research piece, we will highlight the effect of two systematic quality factors that, when applied to the Top 100 portfolio, have led to significant outperformance relative to the unfiltered portfolio. Both factors are systematic and have rational economic underpinnings. This is important, as data mining in systematic investing can lead to a portfolio over-fit to past performance, leading to a lower ability to predict future performance.

While we hold the details of our findings as proprietary, it is important to note that our factors were created with data that would have been readily available at the time of each historical portfolio’s construction, and that the methodology of each factor is unchanged throughout the entirety of the back-testing we perform. This should alleviate concerns about survivorship or other hindsight biases in the results.

Additionally, we note that we are approaching these quality factors from the perspective of an investor, as opposed to merely a research content producer, and accordingly we are incented to test our factors in a manner that will gauge whether our factors have real predictive power. As such, we have been diligent about not overfitting the data and avoiding survivorship and hindsight biases. Ultimately, only the future persistence of these factors can validate them, but historically these factors have already led to improved performance in nearly every individual quarter vs the unfiltered Top 100 portfolio, and we fully expect that the application of the quality factors we have discovered will continue to lead to outperformance.

Factor 1: Binary Quality Filter

The inspiration for our first factor, which we will refer to as Filter 1 in the sections that follow, came when we were compiling the data for the broadly diversified portfolios discussed in Part I of this series. We noticed that many of the worst performing tokens in any individual quarter shared a common characteristic, and we believed that there were rational economic grounds for any token exhibiting that characteristic to underperform. We then decided to conduct a more thorough back-test where we would systematically exclude any tokens that demonstrated this attribute on the day of the portfolio’s construction. For example, if we were creating the portfolio for Q1 2022, we would apply this filter based on a token’s characteristics on the prior close, or December 31, 2021, in this case. Thus, our first quality factor was born. From Q1 2020 through Q4 2022, Filter 1 excludes an average of 18 tokens from the Top 100 portfolio, with a high of 34 tokens in Q4 2020 and a low of 11 tokens in Q4 2022. As demonstrated in Exhibit 4, the application of Filter 1 to the Top 100 leads to persistent and significant outperformance relative to the unfiltered Top 100.

Exhibit 5: Quarterly Outperformance of Top 100 + Filter 1 Portfolio Relative to Unfiltered Top 100

The only significant incidence of Filter 1 leading to underperformance relative to the unfiltered Top 100 occurred in Q1 2021. However, this was a quarter where token prices skyrocketed almost unanimously, with little discernment for high- or low-quality projects. That said, the Top 100+Filter 1 portfolio still returned over 300% in Q1 2021 alone, which does make the 1.7% underperformance somewhat negligible. In other periods, the filter provides consistent and significant performance improvements.

Exhibit 6: Cumulative Impact of Filter 1 on Held Since 2020 and Held Since 2021 Timeframes

When analyzing portfolio performances on ‘Held Since 2020’ and ‘Held Since 2021’ timeframes, the impact of Filter 1 becomes quite impressive. Applying Filter 1 leads to ~100% increase in returns if invested since January 1, 2020. Moreover, the application of Filter 1 transforms the Top 100 from a portfolio that underperformed Value-Weighted BTC+ETH into a portfolio that materially outperformed this benchmark.

Factor 2: Ranking System Based on Historical Metrics

The compelling success of Filter 1 inspired a continued search for additional quality factors. Over the last few months, we have identified and tested a multitude of potential factors, some of which are borrowed from prevailing equity factors, and others that are more specific to cryptocurrencies and tokens. While many of the factors we have tested show promise of a potential ability to predict outperformance, none stood out quite as much as ‘Factor 2’, which we discuss in this section.

While Filter 1 is a binary rule where tokens either satisfy or fail to satisfy a condition, Factor 2 is a spectrum: We rank each token in the Top 100+Filter 1 universe along historical metrics in the preceding quarter, and then exclude the 40% of tokens ranked the worst in this metric. We provide support for this bottom 40% cutoff number in Exhibit 6 below. Additionally, note that Factor 2 is layered onto the Top 100+Filter 1 portfolio. Considering the high persistence of Factor 1, we sought to assess how we could further augment it as opposed to restarting from the unfiltered Top 100.

Exhibit 7: Returns of Factor 2 Quintiles Since 2020 and 2021

In the above analysis, we take the Top 100 + Filter 1 portfolio and calculate the Factor 2 ranking for each constituent token. The 20% of tokens with the highest ranking are grouped as Quintile 1, and next 20% are Quintile 2, and so on. In Exhibit 6, it is apparent that performance falls off dramatically for the bottom two quintiles—in other words, the tokens that had the worst Factor 2 statistic in the preceding period tended to underperform in the following quarter. Accordingly, we define Factor 2 as the set of tokens in the top quintiles, or Top 60%, of this statistic.

Exhibit 8: Quarterly Impact of Applying Factor 2 onto Top 100 + Filter 1 Portfolio

While there are a few instances of Factor 2 adversely affecting performance, we are encouraged by both the persistence and magnitude of the performance improvements over both the unfiltered Top 100 and the Top 100+Filter 1 portfolio. Particularly encouraging are the performance improvements during drawdown periods, with the application of Factor 2 outperforming the Factor 1 Only portfolio by 4-10% in every quarter in 2022 (which was a particularly bad year for crypto and other risk markets).

Putting It All Together: A Factor-Driven Portfolio

By now, we hope to have provided ample evidence that Factors 1 and 2 have an ability to systematically isolate higher quality projects and improve portfolio performance. As we move forward, we will call the broadly diversified (generally the Top 100) portfolio with the application of Factors 1 and 2 our factor-driven portfolio.

Exhibit 8 below highlights the compelling performance of the factor-driven portfolio, exhibiting superior raw and risk-adjusted returns over the duration of this backtest. Again notable is the performance in a down year like 2022. While delivering highly differentiated upside performance in strong years, the portfolio with added quality filters continues to show performance in line with a value-weighted portfolio of BTC/ETH during drawdowns. That is, the returns show asymmetric upside with minimal additional drawdown risk. It may seem counter intuitive that the “quality” portfolio can still exhibit slightly greater drawdowns, but remember that inherently this is a much broader portfolio, including many tokens that are far removed from the “safe haven” quality of BTC and ETH.

Exhibit 9: Factor-Driven Portfolio Historical Performance

Quantifying Our Decisions

In building up to the factor-driven portfolio, there are several key decisions we are making: Expanding to the top 100 tokens, assigning equal weights to each token, and applying Factors 1 and 2 to the broader selection. Each have independent impacts on total portfolio performance, impacts that can be easily quantified. Exhibit 10 shows the bridge from the Value-Weighted BTC+ETH return to the factor-driven portfolio return, thus allowing us to decompose the key drivers of the factor-driven portfolio’s performance over various time intervals.

Exhibit 10: Factor-Driven Portfolio Return Decomposition

Conclusion

Our research in Parts I and II of this series revealed the potential of broadly diversified portfolios of cryptocurrencies. As the crypto space grows and matures, we expect the number of legitimate projects with liquid tokens to expand, pushing value well outside just the top handful of tokens. However, broadly diversified portfolios can also benefit from intelligent application of systematic factors designed to identify projects with strong fundamentals and reduce the probability of capturing low quality projects. We showed in this piece that even layering on just two simple factors significantly improved performance relative to both common market benchmarks and the unfiltered portfolio. Academic research supports our ambitions of finding useful factors for investing in cryptocurrencies, and we see potential in combining and refining systematic rules for our broadly diversified portfolios. On top of this, our research program will continue to search for factors with strong fundamental grounding, and not just over-fitted data.

While we are excited about the results shared in this piece, this is just the beginning. There remain a multitude of factors to examine and tests to perform, and most critically, performance to be observed. In fact, the wealth of data to test leaves us at once excited yet in awe. This is largely uncharted territory in the domain of applied crypto investing, and we are excited to find what alpha there is yet to be uncovered.

Footnotes

“Toward a Theory of Market Value of Risky Assets”, Jack Treynor, 1962, Link

“Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk”, William F. Sharpe, The Journal of Finance, 1964, Link

“The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets”, John Lintner, The Review of Economics and Statistics, 1965, Link

“Equilibrium in a Capital Asset Market”, Jan Mossin, Econometrica, 1966, Link

“Common Risk Factors in the Returns on Stocks and Bonds”, Eugene Fama, Kenneth French, Journal of Financial Economics, 1993, Link

“A Census of the Factor Zoo”, Campbell Harvey, Yan Liu, 2019, Link

“A Global Guide to Strategic-Beta Exchange-Traded Products”, Morningstar, 2022, Link

“Asset Pricing of Cryptocurrencies and Momentum based Patterns”, Jaron Stoffels, 2017, Link

“Common Risk Factors in Cryptocurrency”, Yukun Liu, Aleh Tsyvinski, Xi Wu, 2019, Link

“The Structure of Cryptocurrency Returns”, Amin Shams, 2020, Link

“Risks and Returns of Cryptocurrency”, Yukun Liu, Aleh Tsyvinski, 2021, Link

“Value Premium, Network Adoption, and Factor Pricing of Crypto Assets”, Lin William Cong, G. Andrew Karolyi, Ke Tang, Weiyi Zhao, 2022, Link

“On Persistence in Mutual Fund Performance”, Mark Carhart, The Journal of Finance, 1997, Link

U.S. Persistence Scorecard Mid-Year 2022, S&P, Link

Disclaimer: The discussion contained herein is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained herein constitutes a solicitation, recommendation, or endorsement to buy or sell any token. Nothing herein constitutes professional and/or financial advice, nor a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or content herein before making any decisions based on such information or other content.

Any performance referenced is for informational purposes only and does not represent an actual investment of Outerlands Capital nor does it include any fees related to investing including transaction fees or management fees, among other fees.

As of the date of this publication, Outerlands Capital Management LLC, a Delaware limited liability company, or its affiliates (collectively, “Outerlands Capital”) may hold or advise on long, short, or neutral positions in or related to the companies or digital assets described herein. The information in this website and any materials presented herein (the “Site”) was prepared by Outerlands Capital, is believed by Outerlands Capital to be reliable, and has been obtained from public sources believed to be reliable. Outerlands Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this publication constitute the current judgment of Outerlands Capital and are subject to change without notice. Any projections, forecasts and estimates contained in this publication are necessarily speculative in nature and are based upon certain assumptions. It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This Site is not intended as a recommendation to purchase or sell any commodity or security. Outerlands Capital has no obligation to update, modify or amend this publication or to otherwise notify a reader hereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Outerlands Capital may transact in any digital asset or the securities of any company described herein.

This Site is not an offer to sell securities of any investment fund managed by Outerlands Capital or a solicitation of offers to buy any such securities. An investment in any securities or digital assets, including the securities or digital assets described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.